excise tax ma calculator

There is no excise tax due where the consideration stated is less than 10000. Divide the total market revenue by the total number of excise goods sold during the.

Online Property Tax Calculator In Punjab Excise Punjab Gov Pk Online Taxes Property Tax Online Checks

We would like to show you a description here but the site wont allow us.

. Massachusetts Form 355 Excise Tax includes a tax of 260 per 1000 on taxable Massachusetts tangible property or taxable net worth whichever applies and a tax of 80 on. - NO COMMA For new. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown.

If your calculated excise is less than 5 you will be taxed 5. Motor Vehicle Excise Tax About. Since 1981 the Massachusetts Registry of Motor Vehicles RMV calculates the value of vehicles for the excise tax at a rate of 25 per 1000 based on the value of the vehicle.

Enter your vehicle costeg. It is charged for a full calendar year and billed by the community where the. Excise tax bills are prepared by the Registry of Motor Vehicles and billed by the local community where the vehicle is garaged.

This method is only as exact as the purchase price of the vehicle. Free massachusetts payroll tax calculator and ma tax rates. Excise Tax Calculator This calculator will allow you to estimatethe amount of excise tax you will pay on your vehicle.

Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. The rate of excise is 2500 per one thousand dollars of valuation.

The excise tax is a state tax calculated at an arbitrary rate one dollar. Any portion of that consideration and value or Interests which are said to be. Calculating the Excise 25 per 1000 of value The excise rate is 25 per 1000 of your vehicles value.

The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. Massachusetts State Excise Tax Calculator. Calculating Motor Vehicle Excise Taxes.

Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. If you own or lease a vehicle in Massachusetts you will pay an excise tax each year. The Massachusetts income tax rate.

How often do you. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. How do I calculate excise tax.

Calculating Motor Vehicle Excise Taxes Motor vehicle excise is taxed on the calendar year. The tax rate is 25 for every 1000 of your vehicles value. It is an assessment in lieu of a personal property tax.

The tax rate is 25 for every 1000 of your vehicles value. It is an assessment in lieu of a personal property tax. The excise due is calculated by multiplying.

The actual excise tax value is based on the Blue Book value as. Motor vehicle excise is taxed on the calendar year. Please note this is only for estimation purposes -- the exact cost.

Chapter 60A imposes an excise on the privilege of registering a motor vehicle or a trailer in the Commonwealth of Massachusetts. The calculator will show you the total sales tax amount as well as the. The minimum excise tax bill is 5.

The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

Excise Tax Calculator The effective tax rate is 228 per 500 or fraction thereof of taxable value. The excise due is calculated by multiplying. The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle tax rate.

Your exact excise tax can only be calculated at a Tag Office. Every 500 spent will be taxed at 1000. Value for Excise x Rate 25 or 0025 Excise Amount.

The formula used to calculate this is the Manufacturers List Price x Ch60A percentage Value for Excise. Valuation information is accessed electronically by the Registry from the National Automobile Dealers Association.

1 869 Large Calculator Photos Free Royalty Free Stock Photos From Dreamstime

2021 Nantucket Property Tax Rates Fisher Real Estate Nantucket

Massachusetts Legislature Passes Legislation Enacting Work Around To Federal 10 000 Salt Deduction Limitation But Governor Baker Sends It Back With Amendment Don T Tax Yourself

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Payroll Training High Resolution Stock Photography And Images Alamy

Income Tax Calculator 2021 2022 Estimate Return Refund

How To Calculate Cannabis Taxes At Your Dispensary

Calculator How Much Tax You Pay On Beer Wine Cigarettes And Spirits This Is Money

Transfer Tax Calculator 2022 For All 50 States

Car Tax By State Usa Manual Car Sales Tax Calculator

Pta Tax Calculator For Import Of Mobile Phones In Pakistan Incpak

Car Tax By State Usa Manual Car Sales Tax Calculator

Payroll Training High Resolution Stock Photography And Images Alamy

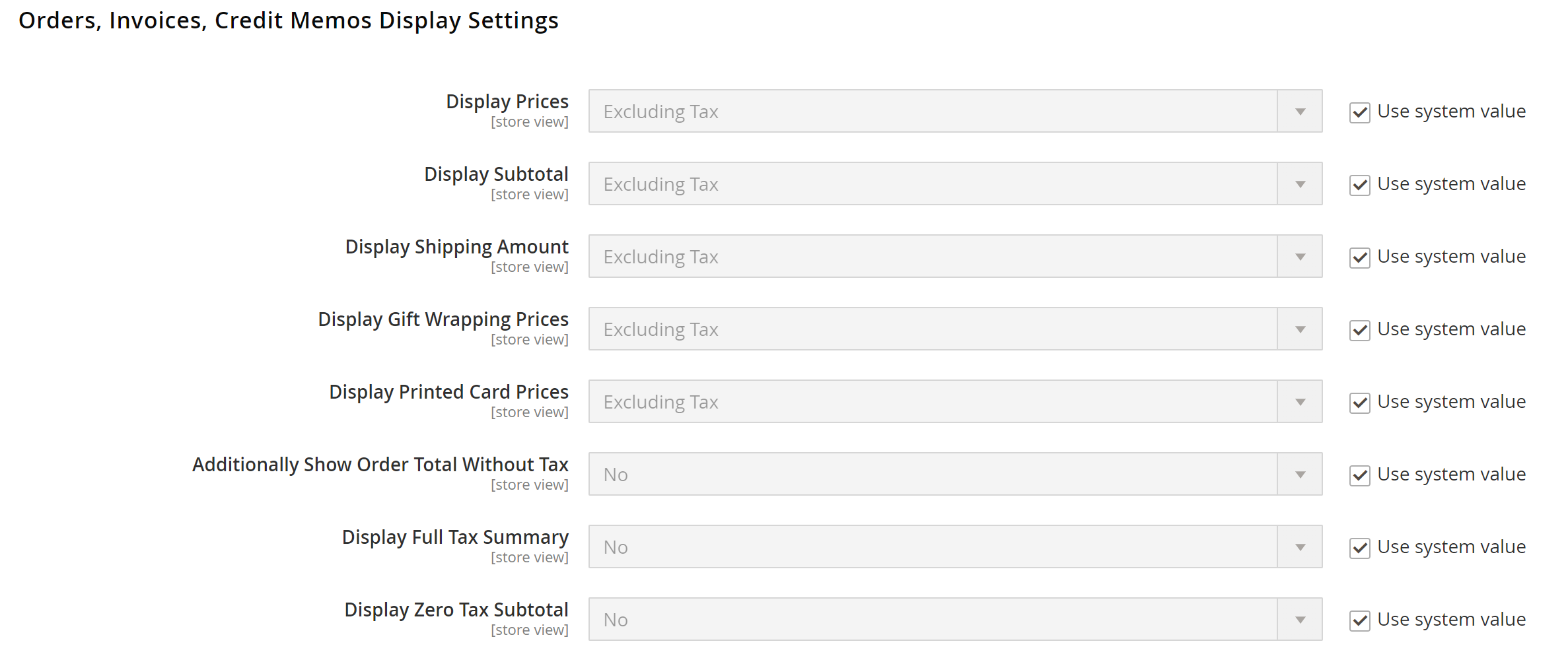

General Tax Settings Adobe Commerce 2 4 User Guide

Massachusetts Enacts Work Around To Federal 10 000 Salt Deduction Limitation Don T Tax Yourself

Excise Tax Frequently Asked Questions North Andover News

1 869 Large Calculator Photos Free Royalty Free Stock Photos From Dreamstime